Equal Opportunity Lending (EOL) in the context of title loans aims to democratize access to financial services by evaluating borrowers based on their secured assets and repayment capacity, rather than discriminatory practices. By adopting fair lending standards, conducting audits, and offering flexible terms, EOL seeks to eliminate barriers that prevent individuals with limited credit or income history from accessing funding, while mitigating the risk of exacerbating existing economic disparities.

“Title loans, despite offering quick cash, pose significant challenges to equal opportunity lending, often exacerbating financial discrimination. This article delves into the core principles of equal opportunity financing and its critical role in fostering inclusive growth. We examine how title loans can create barriers for marginalized communities and explore strategies to overcome these hurdles. By implementing fair lending practices and innovative solutions, we can promote equal access to credit and ensure a more just and inclusive financial landscape.”

- Understanding Equal Opportunity Lending and Its Principles

- The Role of Title Loans in Financial Inclusion and Discrimination

- Strategies to Overcome Discrimination in Title Loan Sector and Promote Equal Access

Understanding Equal Opportunity Lending and Its Principles

Equal Opportunity Lending (EOL) is a concept that ensures financial services are accessible to all individuals, regardless of their background or personal circumstances. It promotes fairness and inclusivity in lending practices, aiming to eliminate any form of discrimination. This approach challenges traditional barriers that have historically excluded certain demographics from accessing credit.

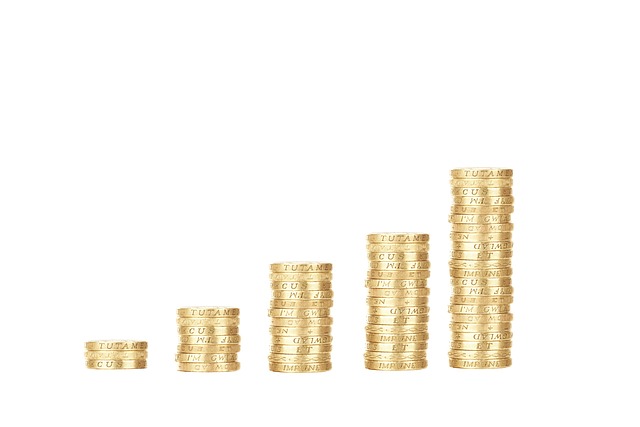

The principles of EOL emphasize transparency, equal treatment, and individualized assessment. Lenders are encouraged to consider an applicant’s ability to repay a loan, rather than focusing solely on factors like credit score or history. In the context of title loans, this means evaluating a borrower’s ownership of a secured asset (like a vehicle) and their capacity to make payments, offering an alternative for those with limited credit options or no credit at all. By embracing EOL, lenders can facilitate access to bad credit loans or no-credit-check loans, ensuring that people with diverse financial backgrounds have a fair chance at obtaining funding through the title loan process.

The Role of Title Loans in Financial Inclusion and Discrimination

Title loans, offering quick access to capital secured by an individual’s vehicle ownership, have both promoted financial inclusion and raised concerns about discrimination in lending practices. On one hand, these short-term loans cater to individuals who may not qualify for traditional bank credit due to inadequate credit histories or limited income verification requirements. This alternative financing option can provide relief to folks in urgent need of funds, including those owning less common assets like motorcycles or non-mainstream vehicles.

However, critics argue that title loan equal opportunity lending often perpetuates and exacerbates existing economic inequalities. The practice disproportionately targets low-income communities and minorities, who may be more likely to own older or less valuable vehicles, leading to a cycle of debt. Moreover, the high-interest rates and fees associated with these loans can trap borrowers in a labyrinthine financial situation, particularly when they are unable to repay on time.

Strategies to Overcome Discrimination in Title Loan Sector and Promote Equal Access

Discrimination in the title loan sector remains a significant challenge, hindering equal access to much-needed financial support for many individuals. To overcome these biases and promote fairness, several strategies can be employed. Firstly, lenders should adopt robust underwriting models that focus on an applicant’s ability to repay rather than perpetuating discriminatory practices based on race, gender, or socioeconomic status. Implementing fair lending standards and conducting regular audits can help identify and eliminate biased practices.

Additionally, offering flexible payment plans and same-day funding can democratize access to emergency funding. Terms like “emergency funding” and “same day funding” resonate with those seeking quick relief during financial crises. By providing tailored solutions and transparent terms, lenders can ensure that all borrowers have an equal opportunity to avail these services without facing discrimination.

Title loans, as a form of alternative financing, have the potential to fill financial gaps for many individuals. However, discrimination remains a significant challenge in this sector. By understanding and adhering to the principles of equal opportunity lending, we can create a more inclusive environment. Implementing strategies to overcome biases and barriers ensures that title loan access is fair and available to all, fostering a true level playing field in financial services.